"1C: Accounting department of a state institution". Working with the chart of accounts and classifiers The purpose of this presentation is to show how in the software product "1C:

"1C: Accounting department of a state institution". Working with Chart of Accounts and Classifiers

The purpose of this presentation is to show how the work with the chart of accounts is organized in the software product "1C: BSU 8" and how you can set up a working chart of accounts for all types of public institutions, namely, for autonomous, budgetary and state-owned.

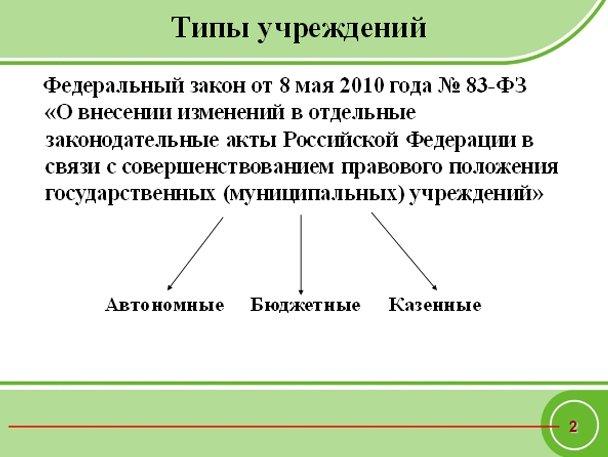

As you all know, in accordance with the Federal Law of May 8, 2010 No. 83-FZ, from January 1, 2011, autonomous, budgetary and state-owned institutions are recognized as types of state, municipal institutions.

In order to establish a unified accounting procedure, Order No. 157n dated December 1, 2010 of the Ministry of Finance of Russia approved the Unified Chart of Accounts and Instructions for its Application.

Order No. 157n came into force on January 1, 2011. In this regard, according to paragraph 4 of this order, Order No. 148n has become invalid.

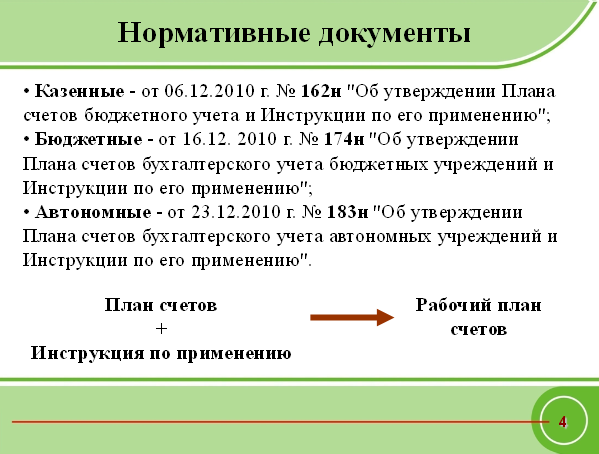

For keeping records by each type of institution, the Orders of the Ministry of Finance of Russia approved the corresponding charts of accounts and instructions for their use.

On the basis of the relevant Chart of Accounts and Instructions for its application, the institution develops and approves a working chart of accounts.

Account structure changed:

from 1-17 digits – this is the classification sign of the account (CPS)

18th category – code of the type of financial support (activity) (KFO)

from 19-23 digits – a single chart of accounts

24-26 digits – an analytical code for the type of receipts, disposals of the KOSGU accounting object or types of payments according to the FCD plan.

And now in more detail about the changes in this structure of the account.

According to the 148 instructions, the budget classification code was reflected in digits from 1-17.

Since 2011, these categories reflect the code according to the classification attribute of receipts and disposals, or the so-called classification attribute of the account, abbreviated KPS;

In terms of budget accounting in these categories, the budget classification is used, in terms of own income and funds in temporary disposal, the classification is chosen by the accounting policy, in terms of subsidies and CHI funds – by the founders.

I would like to note that in these symbols for government institutions, a regulated budget classification is used, and budgetary and autonomous institutions can use an arbitrary classification, but if it is convenient for them to use the budget classification for internal accounting, they are not prohibited from doing so.

18th category – code for the type of financial support (activity), abbreviated KFO (previously, according to instruction 148n, this is the code for the type of activity (KVD)).

As you can see on the slide, codes from 1-3 remained the same as for instructions 148. I would like to draw your attention to this point, since subsidies are an innovation, therefore they are allocated to separate QFAs in order to be able to track "Targeted Funding" and expenses within it.Previously, medical institutions suffered by separating the funds of the FSS, and now it is a separate CFD at number 7.

The 19-23 digits of the account number of the Working Chart of Accounts reflect the synthetic account code of the Unified Chart of Accounts – balance sheet classification, where

19-21 symbols are a synthetic score.

22 – analytical account of the accounting object group.

23 – analytical account of the type of accounting objects.

A good example is the cash account. The analytical account of the group of the accounting object was used before, but it did not carry any semantic load. Now, using the analytical account of the accounting object group, you can divide the funds in the treasury bodies and on the accounts of credit institutions.

The 24-26 digits reflect the analytical code of the type of receipts, disposals of the accounting object.

For state-owned institutions and budgetary institutions, 24-26 categories reflect the codes for classifying operations of the public administration sector (KOSGU), for autonomous institutions – an analytical code for receipts, disposals of accounting objects, in the structure approved by the plan of financial and economic activity.

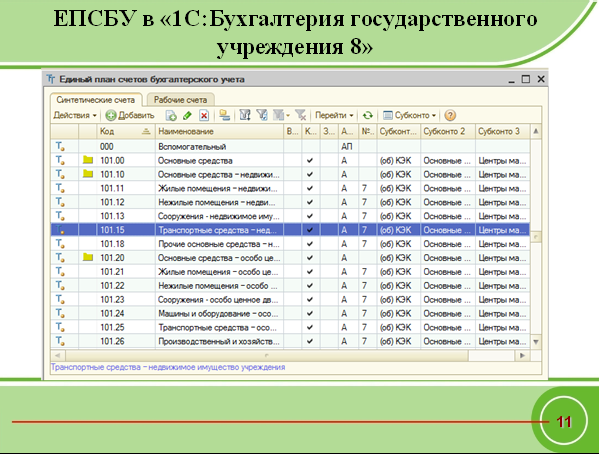

And now let's move on to the most important thing, namely, let's see with you how work is organized with a single chart of accounts in the software "1C: Accounting of a state institution 8".

The software product "1C: Accounting of public institutions 8" was developed for both budgetary and state-owned and autonomous institutions using a single chart of accounts. Those. This software product allows you to keep records in public institutions of all types. This is a significant advantage of BSU, because if necessary, the new configuration assumes the possibility of changing the type of institution at any time of record keeping, for example, in the middle of the year. Thus, if, in the middle of the year, it turns out that the type of institution does not correspond to the chart of accounts, in accordance with which records are kept from the beginning of the year, when switching from budget to state, or from state to budget, you will not have to buy a new one. product, and the transition itself will be carried out within the same information base simply by changing the type of institution.

The program "1C: Accounting for public institutions 8" has a chart of accounts that contains a list of balance and off-balance accounts according to the Unified Chart of Accounts.

You can add new accounts to the chart of accounts and add new sub-accounts to existing accounts.

Account settings are made in the account card.

- The standard configuration for all regulated accounts provides for the possibility of keeping records in the context of types of financial collateral (CFS), classification features of accounts (CPS), sources of collateral. As I already said, the earlier software “1C: BGU 8” allows you to keep records both in budgetary and state-owned and autonomous institutions, in connection with this, signs of application by each type of institution are established for each account.

- For each account, you can set additional sections of analytical accounting and set up total and quantitative accounting for them.

- It is also possible to set the allowable codes for the economic classification of the account, as well as the allowable types of account classification attributes.

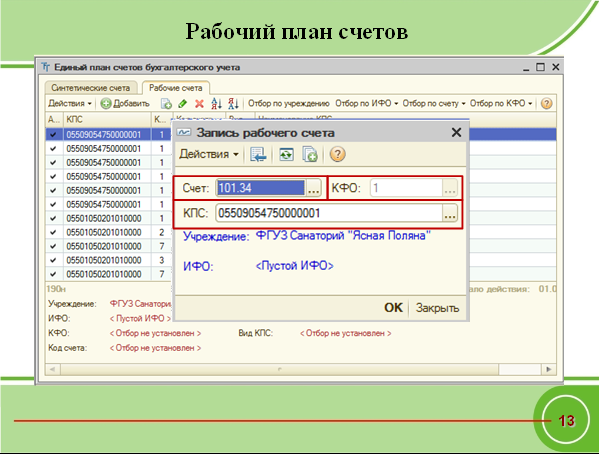

1C: Accounting of a public institution 8 provides for the formation of a working chart of accounts for each institution, which is accounted for in the program. At the same time, the structure of the accounts of the working chart of accounts can be set in accordance with the type of institution (whether it is a budgetary, state or autonomous institution) and the types of its financial support.

The structure of the account of the working chart of accounts is a combination of CPS (classification attribute of the account), CFO (code of the type of financial security), the account itself.

Let's consider with you what classifiers are used in the formation of the account of the working chart of accounts. Classification characteristics of the account (CPS) are indicated in the corresponding directory, where for each CPS you can specify the type of classification attribute of the account. As you know, the list of analytical codes on the classification basis of receipts and disposals is determined by the Accounting Policy of the institution for a certain period. In this regard, for the elements of this directory, it is possible to specify the period of validity.

The "Economic Classification Codes (ECC)" handbook is supplied complete and contains general government transaction codes (KOSGU).

In "1C: Accounting for public institutions 8" it is possible to customize the structure of the working chart of accounts in accordance with the type of institution, which is indicated in the accounting policy of the institution.

At the same time, in setting up the structure of the working chart of accounts for each type of institution, it is possible to specify for each financial security code which classification by CPS and CEC will be used: budget or arbitrary.

Let me remind you once again that earlier, according to Instruction 148, a regulated budget classification was used for all types of institutions. Now, only for state-owned institutions, regulated budget classification is mandatory. Budgetary and autonomous institutions can use an arbitrary classification, but if it is convenient for them to use the budgetary classification for internal accounting, they are not prohibited from doing so. So, which classification you will use is determined in setting up the structure of the working chart of accounts.

This is how you can easily and quickly set up the ability to use a single chart of accounts, as well as a working chart of accounts for all types of government agencies.